Pool Landscape Report - April 2023 Week 4

Table of Contents

- Pool Landscape Updates

- Noteworthy Micro Updates

- What We’re Watching: The Power of ISPO Pools

- BALANCE Updates

Pool Landscape Updates

(4/16/23 Epoch 406 -> 4/30/23 Epoch 409)

Single ITN Pools are spooling down, and multiple ISPO and Exchange pools are spooling up.

Eighteen (18) new pools have been created since the last report about 2 weeks ago. Ten (10) of the new pools are from UPBIT, a Korean Crypto Exchange.

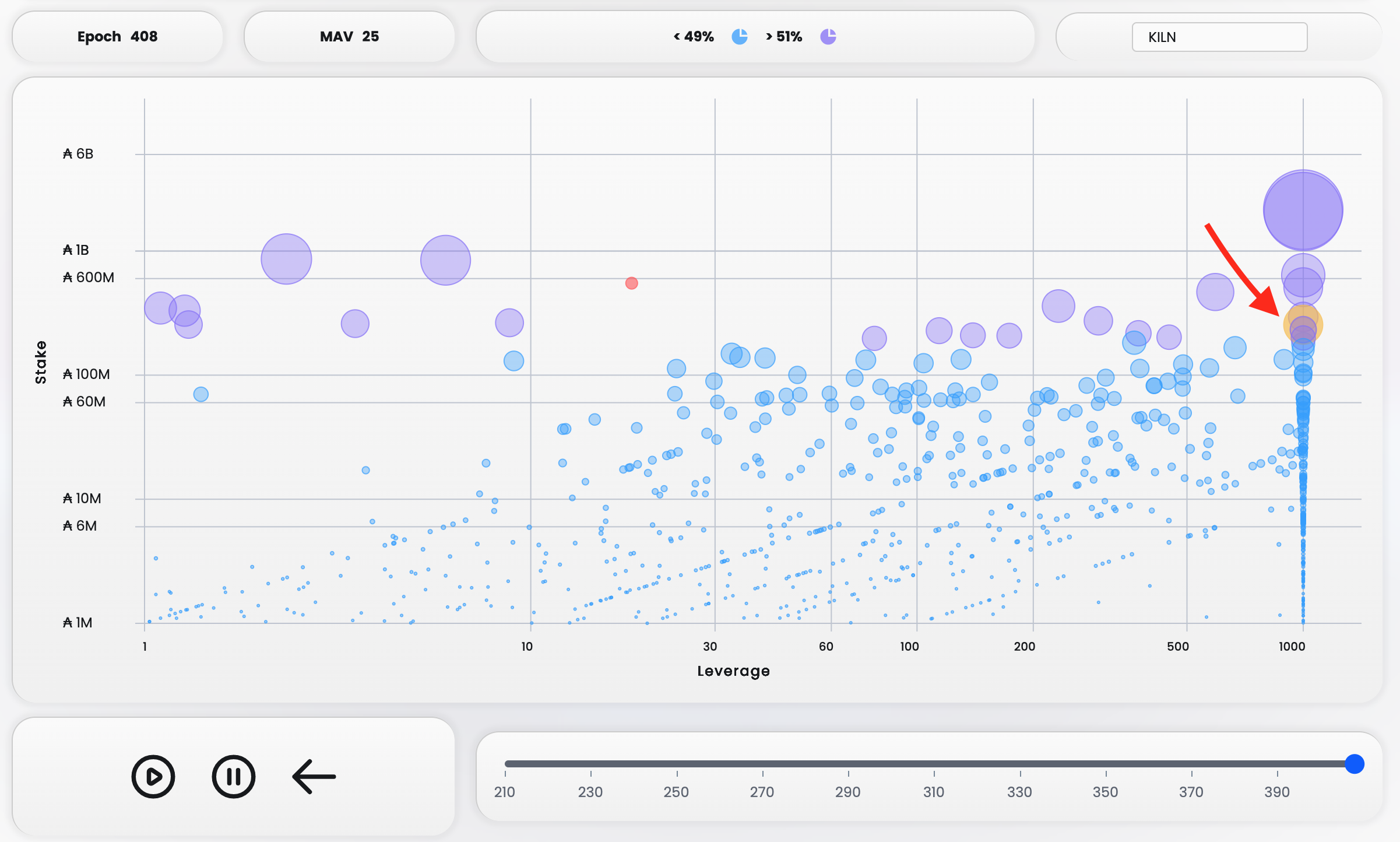

The newish multi-pool KILN is offering a “Whitelabel Staking Service” that is starting to gain significant stake from a pretty deep network of VC partners and Enterprise.

Of significant note is ITN Single Pool SOBIT with 45MAda announced they are retiring. This will move a lot of stake, and hopefully to single pools which they recommended.

But, watch out for ISPO Pools to gain traction soon and potentially attract that delegation like moths to a flame.

ITN Era Single Pools Closing: SOBIT & ADAGL

An Ode to SOBIT and ADAGL

The SOBIT stake pool has announced their retirement in just two months, which comes as a significant blow to the Cardano community.

With 45 Million Ada (MAda) in stake, SOBIT was one of the largest pools on the network. This news will lead to a redistribution of their stake, and it’s important for the Community to keep an eye on which pools delegation flows into.

Because we can't keep up the usual quality of our stake pool service (mostly due to time constraints), we would like to announce the retirement of our pool with the 1st of July 2023.

— SOBIT Pool - Retired on 1st of July! (@SOBITADA) February 27, 2023

We put some pool recommendations on our site: https://t.co/ECslQmnlUN

SOBITs, or “Staking Out of Bit”, was a verified ITN Single Stake Pool with significant contributions to Cardano. From their website, they were ardent supporters of single pool decentralization.

“We are an independent and reliable stake pool for the Cardano blockchain from Austria, operated by IT professionals. We adhere to the principle of “one pool per operator” to support decentralization.”

Fortunately, they have recommended a handful of other established single stake pools. Hopefully, their delegators are receptive to the recommendation, and the re-delegation does not affect the MAV. Such stake, properly distributed to other pools, could have an immediate impact on the MAV numbers.

So far scrolling SOBIT on Pool.pm, the stake seems to be evenly distributing to some pretty large high performance pools, but at least the stake is spreading out.

Also, ADAGL, or ADA Globe, announced is retiring at Epoch 408 with 500kAda of Stake:

Hi All,

— ADA Globe - Ticker : ADAGL (Retiring) (@GlobeAda) April 15, 2023

This is to notify you that ADAGL pool will be retiring soon. Kindly delegate your stake to some other pool to continue earning staking rewards. Thanks to all delegators who helped us to maintain the pool for a long time.

Their website says they supported “ITN and Mainnet Shelley Nodes”, and at their height had about 17MAda Live Stake.

We thank SOBIT and ADAGL for their legendary contributions to get us this far in Cardano PoS.

Now enter the new players…

KILN - 4 New Pools - SaaS Whitelabel Staking for Enterprise

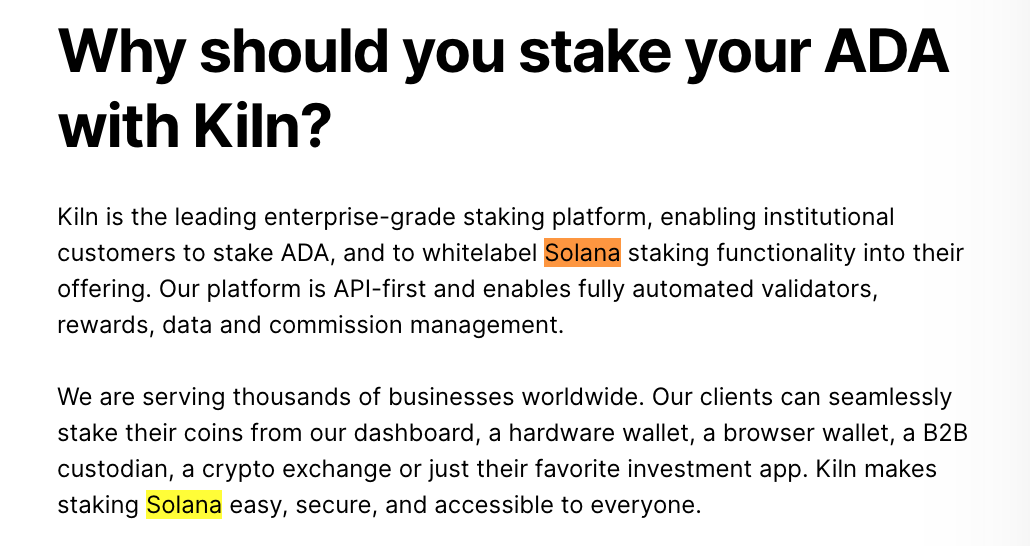

KILN is another Staking-as-a-Service company based out of Paris Fance. They have a pretty nice dashboard for “whitelabel staking” aimed for Enteprise and VC Customers.

From their website they describe themselves as:

“Enterprise-grade staking made easy. Stake your treasury directly, or bring staking to your users through our whitelabel product.”

KILN started Ada Stake Pool Group in Epoch 358 of August of 2022, but the big money started really accumulating in Epoch 397 of March 2023 (See KILN0).

At the time of writing, they opened four (4) pools (KILN 0 thru 3) with Live Stake of combined 257MAda, and 400Ada of pledge, with a total of 17 delegators. That’s a lot of Ada, no small pup.

This yields a Pool Group Leverage of 643,604x. Guess where they are in the Stake vs. Leverage Chart:

No mention of Cardano in their twitter @Kiln_finance.

Someone should also let them know Solana ain’t Cardano on the Cardano Staking Page:

Looks like they care as much about Cardano as their pool pledge reflects. We should help them out.

UPBIT - 10 New Pools - South Korean Crypto Exchange

UPBIT is a South Korean cryptocurrency exchange. It was founded in 2017 by the Korean fintech company Dunamu Inc. and has become one of the largest exchanges in South Korea. If you go under the Korean language option in the website landing page, there’s a ton more details to translate than the English version.

At the time of writing, they have opened ten (10) new pools all under UPBIT, with a combined Live Stake of 97MAda, and 2MAda pledge (not bad), and a total of 10 delegators. All the pools have 200kAda pledge and 100% margin fee.

This yields a Pool Group Leverage of 48x, which is actually exceedingly excellent for Exchange pools. We’ll leave the exercise up to the reader to find them in the Stake vs Leverage Chart.

Not too shabby UPBIT. No Cardano tweets yet though from @Official_Upbit.

Multiple ISPO Pools Opening Under the Radar

Among the eighteen new pools that have been created since the last report, some interesting findings have emerged on the public blockchain. Specifically, it appears that multiple new ISPO pools may be on the horizon.

Shareslake [SHRLK]

One (1) new pool registered on-chain was SHRLK from the former Cardano Side-chain Stablecoin effort Shareslake. You can read more about them from an Adapulse article by Blocksplain: Shareslake : A Fiat-backed Stablecoin and Ecosystem – A Sidechain of Cardano

Anyway, the interesting tidbit is that the website www.shareslake.com redirects to paybycrypto.app (a website), which looks like a new project. Something is in the works it seems, but ETH based?

Occam.fi [CHKR1] ISPO

One (1) new pool registered was CHKR1, which seems to the an Occam ISPO pool for $CHAKRA token. Occam has been around Cardano for a few years now and describes itself from their website as “Interchain incubator DAO & DeFi powerhouse”.

It now looks like Occam is in the ISPO-as-a-Service Business. If you stake in the CHKR1 pool, you will get the $CHAKRA token which seems to be Occam’s DAO governance token

Per the CHKR1 FAQ Docs

“The $CHAKRA token represents a weighted basket of all the incubated project tokens deposited in a tokenized pool. It will be tradable in secondary markets, and its value would be exposed to the value of each token deposited in the tokenized pool.”

Occam could be trying (again) to become the birthplace of ISPO projects as an incubator launchpad.

Are both Sharelake and Occam projects back from the dead in Cardanoland?

Iagon Liquidity Stake Pool Offering, IAGL1

Yet another new pool registered was IAGL1 of Iagon.

Iagon, “The first Cloud Computing Platform on Cardano”, recently announced on twitter that they are launching a Liquidity Stake Pool Offering (LSPO) on Minswap, for which they will be offering $IAG tokens. Per the blog post:

Iagon aims to incentivize liquidity for the $IAG token by rewarding users who stake in our newly listed pools on Cardano DEXes and participate in the LSPO.

“It is set to unleash its power on the DEXes Minswap and Wingriders, as well as the LSPO (Liquidity Stake Pool Offering) pool, in collaboration with the Norwegian crypto exchange, NBX & ADAnorthpool for additional rewards for those who participate.”

Interestingly enough, Ada North Pool ANP seems to have disclosed to the Cardano Single Pool Alliance that he was going to run another pool for a business, which looks like Iagon Pool.

Honestly, Iagon is a pretty cool project and at least they are keeping it single pool. Keep your eyes on IAGL1 to potentially flood with stake like FAX of Orcfax ISPO did.

Noteworthy Micro Updates

- Cardano Foundation (CF) Whales have migrated to a new Cohort of pools focused on building.

- Liqwid Finance (LQ) announced a new Cohort 2 community delegation to single pools. Much respect to the Community Delegation initiative as we dogpiled in the tweeting positive recognition!

- CF and LQ Community Delegation definitely stirs up some staking changes and volatility, but as the delegation is to single pools, these whale delegation changes should have no significant affect on MAV. The smaller fish might scatter though from the pools the Whales left.

- PRIDE Pool aka “Stake With Pride” passed 10k followers on Twitter and is a single pool doing great work. Congrats! He’s also a supporter of CIP-50 research and decentralization. Checkout this tweet and classic throwback debute of Dr. Liesenfelt on Reward Sharing Scheme (RSS) research with Rick [DIGI].

Read Dr. Michael Liesenfelt's @DrLiesenfelt CIP that updates the #Cardano rewards equation to better utilize pledge. https://t.co/AxNydXkx1G

— St₳kΣ with Pride 🌈 (@StakeWithPride) March 26, 2022

Then watch @RichardMcCrackn's full interview as there's a lot of good info not in this clip! https://t.co/CZcihBdJGj pic.twitter.com/98WrptZuyc

- NMKR went from 1M pledge to 800k on paper, but they still have ~1MAda plegde in their wallet. They went “private” to 99% margin three (3) months ago. Interesting as we did not know they had a pool. Glad it’s a single high pledge pool. Is this an ISPO for $NMKR? Not sure yet.

- Cardanians CRDNS private pool discovered: It’s a big boy of 42.5 Million Ada. You can tell by the relays here.

- BLADE has reached Saturation! This great news not only from a maximum reward perspective, but also that Conrad pledges to remain a single pool. Congrats to BLADE and team, a shining star of success and leading by example, as per below. Well deserved.

BLADE reached 99.4% saturation this morning. This is a great thing! Cardano is designed to operate with 500 fully saturated pools (K=500). The ideal scenario is 500 independent pools all operating at or close to 100%. This guarantees the most rewards to delegators.

— $conrad (@conraddit) May 1, 2023

BLADE won't… pic.twitter.com/qMcNl4NJMZ

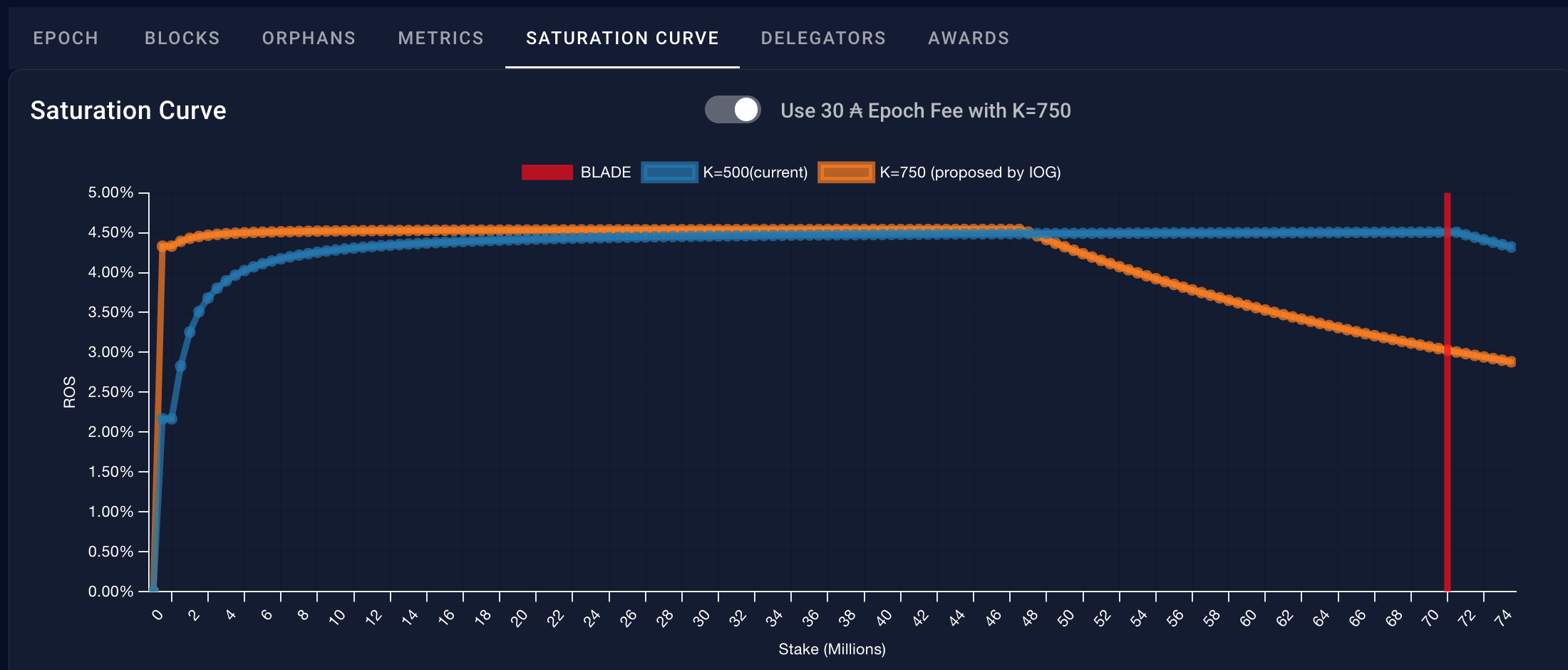

If you weren’t aware, Pooltool.io now provides saturation curve graphs which are a handy visualization tool. Here’s BLADE’s below:

What We’re Watching: The Power of ISPO Pools

It’s no secret that ISPO pools have the power to pull delegation away from many single pools, thus affecting MAV and network health (not to mention ADA sell side pressure).

Just look at how fast FAX pool saturated for the OrcFax ISPO, 0 to Saturated in 10 Epochs.

Therefore, we are watching the following ISPO Pools that will likely open in the next few weeks or months. The impacts and pros and cons of ISPO Pools will have to be a separate article in the future.

- Spectrum Finance ISPO: SpectrumFi (formerly ErgoDEX) is launching cross-chain to Cardano and pursuing an ISPO per their twitter announcement

- SpectrumFi open sources everything and have a steadfast grassroots community. We’ll keep an eye on these potential pools as this launch may be big.

- Iagon ISPO might be hot and rip like FAX, removing pool stake from many single small pools.

- Goofy Goofers: Goofy Gophers Mining Club, [GGMC]. Not entirely sure what this is yet, but seems like a PoW for PoS project with degen NFTs built in. Keep your eyes peeled for any new pools looking like GGMC. It seems to be quite popular, and apparently a legitmate project.

- Goofy Gophers Mining Club | SOLD OUT per on Twitter name

- “Miners have started to arrive in Iowa ⛏️ Soon, they’ll be working day and night to power the GGMC and pour liquidity into #ADA ☀️🌙 #UtilityCNFT”

- Hat tip to Bison Coin for this tipoff. He said he’ll have an in-depth article review.

First project to bring the real world generated revenue back it's cardano investors

— Bison Coin 🉐 (@bisoncoin_io) April 23, 2023

If this is not bullish then idk what is 🤍🚀#ggmc $ada https://t.co/yjCpcbUqk5

As mentioned earlier, the effects of ISPO Pools and their impact on Cardano’s network decentralization will be discussed in a future article. BALANCE is currently neutral on the matter, unless it begins to affect small single pools by drawing away their stake or becoming involved with risky tokens whose owners cashout to fiat 100% of their ADA staking rewards.

- Total staked dropping to 67%: Are DeFi offerings providing better returns than staking? Why the decrease in staked ADA? This is something to monitor as DeFi gains momentum and Total Value Locked (TVL) increases. Will the staking percentage decline? If individuals can earn better returns in DeFi compared to staking (which will decrease over time as reserve rewards reduce), it could be a cause for concern. Many thanks to LiberLion for bringing this topic to our attention.

1/3#DeFi is a problem for PoS

— Li₿εʁLiøη (@liberlion17) April 21, 2023

PoS is secure if delegators are incentivized to staking, but if they can get better returns elsewhere, they can withdraw their cryptocurrencies and go with their funds where it yields more. If this happens, the network becomes less secure.

BALANCE Updates

CF Delegation Grant for BALNC Round 2

We thank the Cardano Foundation for another round of Grant Delegation to BALNC Pool! This makes round two (2). We are very fortunate, thank the CF, and will build more community charts as promised!

Note: You can see the full list of current CF community delegation pools on Pool.pm here. Community delegation is the way.

The Public Pool Group API Updated to Include Pool Tickers

In our last pool landscape report, the great STR8 pool made a community request if the Public BALANCE Pool Group API could be updated to include pool tickers.

Might I suggest to add a third attribute "pool_ticker" next to "pool_hash" and "pool_group" to double check and validate the list and for more human-readability?

— Straight Pool,💧 (@Straightpool4) April 18, 2023

It’s not a bad idea, and we are delighted to announce that the update has been incorporated!

Don’t forget to bookmark the API, share it freely, and suggest more requests.

Enjoy: https://www.balanceanalytics.io/api/groupdata.json

New BALANCE Rack Server Dedicated to DB-Sync

More great news: as the Pool Node and DB-Sync storage requirements are quickly on the rise, we have provisioned for future growth and performance and have procured and installed a new rack server dedicated to DB-Sync and BALANCE On-chain Analytics.

We are making big upgrades to exceed current and future hardware requirements by at least 1.5x using the best-in-class technology. DB-Sync has been successfully re-spooled up and 100% synced with the blockchain tip!

We’ll have more pool and DB-Sync information coming to our website pool page in the future. There is too much building for now, but you’ll be impressed with the bare-metal setup, for sure.

By the way, have you noticed the quiet jump in the minimum RAM size requirement for Cardano Node from 16 to 24GB with the latest 1.35.7 release? It’s definitely increasing rapidly. Pay attention, folks. Have your pools been impacted? Many small pools perhaps will be in the coming 1-2 years (gulp).

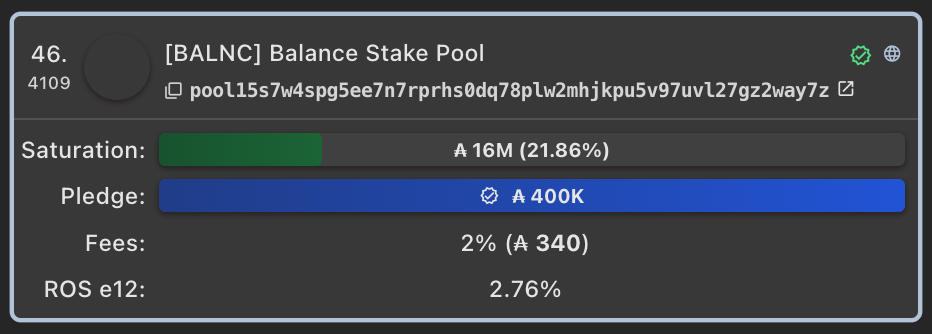

BALNC Pool Eternl Now Ranked #46!

With the updated pledge from 300kAda to 400kAda, we are now super thankful and proud of our high pool ranking in Eternl Wallet of #46.

Eternl uses a pool ranking scheme based not just on performance and reliability, but also values and weighs pledge much more than Daedalus. We believe they also downrank multipools too based on how many. We wish they would open source the scheme!

Pool ranking actually has a powerful psychological impact. For instance, we are ranked #46 in Eternl but only #541 in Daedalus as of Epoch 408. This is obviously a wide margin based on what is valued and weight ranked. We should have easy-to-understand and find assumptions to aid in decision-making.

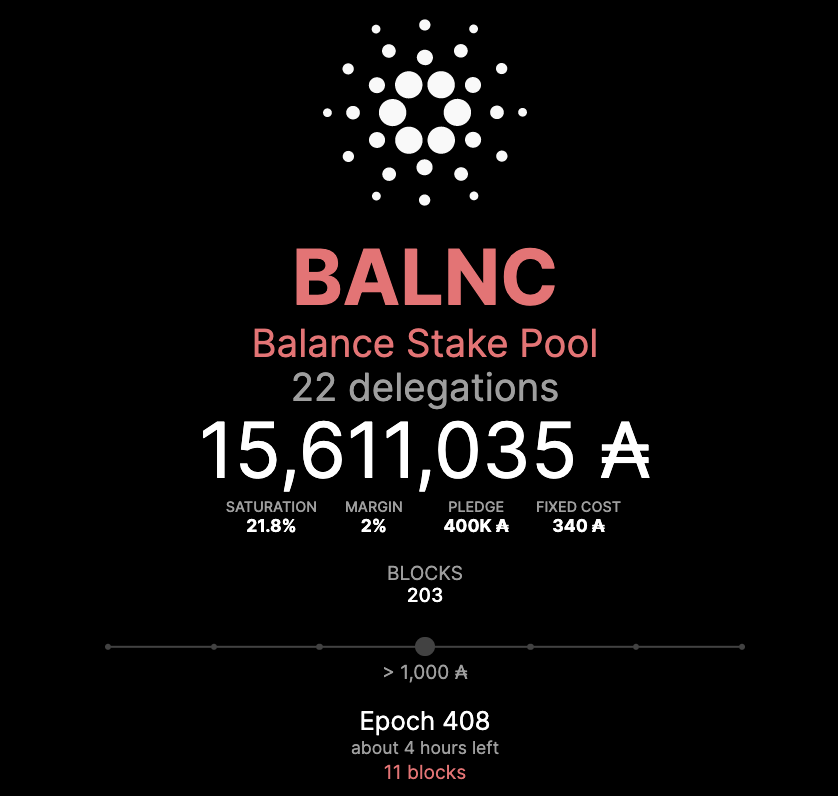

BALNC Pool Passes 200 Blocks!

BALNCE Pool has surpassed 200 Blocks! A new personal record, and many more to come strengthening the network.

Cheers,

The BALANCE Team

If you would like to support future research and blockchain analytics, please consider delegating to Balance Stake Pool - [BALNC].

Join the BALANCE Matrix server to get involved and meet the team. Stop by today to help build a more resilient blockchain network.

Join BALANCE Matrix Server