Pool Landscape Report - June 2023 Week 1

Table of Contents

- Pool Landscape Updates

- Noteworthy Community Updates

- Topic: SPO Reward Sharing Scheme (RSS) Parameter Vote: k and minPoolCost

- Single Pool Spotlight: A4G Post Pool Voting Dashboard

- What We’re Paying Attention To

- BALANCE Updates

Pool Landscape Updates

(5/15/23 Epoch 412 -> 05/30/23 Epoch 415)

Binance is Back with New Pools, A Call To Action for Pool Re-Delegation, Cardano Foundation Reward Sharing Scheme Polel Results, BALNC Pool with 4.88% ROS Last Epoch!

Welcome back to the BALANCE Stake Pool Landscape Report. Here’s the big macro picture of what has changed since last time.

Eight (8) New Pools, New MPO FIGMENT, NEW GIRL Scoop

Since 5/15/23 Epoch 411, the following pool actions have taken place:

- Eight (8) new pools were created since the last pool group dataset review/update.

- One (1) pool belongs to the IDP, which is IDO PASS DAO. From their website:

"IDO PASS DAO is a Launchpad, DAO, Incubator, On-Chain Mapping. IDO Pass DAO is the first Cardano DAO to focus on IDOs, launchpads, and Blue chip CNFT fractionalization."

- FIGMENT is a new pool group forming, with two (2) pools so far. They are an institutional Stake-Pool-as-a-Service (SPaaS) company that honestly has a very sophisticated website. It reminds me of Vanguard's style. From their website:

"Digital Asset Staking Built for Institutions. The complete staking solution for 200+ institutional clients, including asset managers, custodians, exchanges, foundations, and wallets, to earn rewards on their digital assets."

- It's interesting how these VC Staking Services, or Staking Pools as a Service (SPaaS), have Cardano at the bottom of their list (or even shown at all) despite its top 10 market cap. Go figure.

- Regardless, it's good to see Cardano joining their service group and API. Maybe we should welcome them and let them know we agree there are no risks to staking and how much better it is than Ethereum...also that Community Delegation is the best option.

🔎 Take a look into @Cardano - a PoS blockchain that aims to improve blockchain scalability, interoperability, and sustainability 👀

— Figment (@Figment_io) April 5, 2022

Learn more 👇https://t.co/9IW89oWOXV pic.twitter.com/g1wldjpCvT

- It's interesting how these VC Staking Services, or Staking Pools as a Service (SPaaS), have Cardano at the bottom of their list (or even shown at all) despite its top 10 market cap. Go figure.

- One (1) existing pool was added to the NEW GIRL group (the pool has approximately 51 mADA). This is a very curious development, with NEW GIRL creating new pools previously and the group activity.

Note: If you are curious exactly which pools, you’ll need to join the Matrix Group Edits Chat to find out! See below.

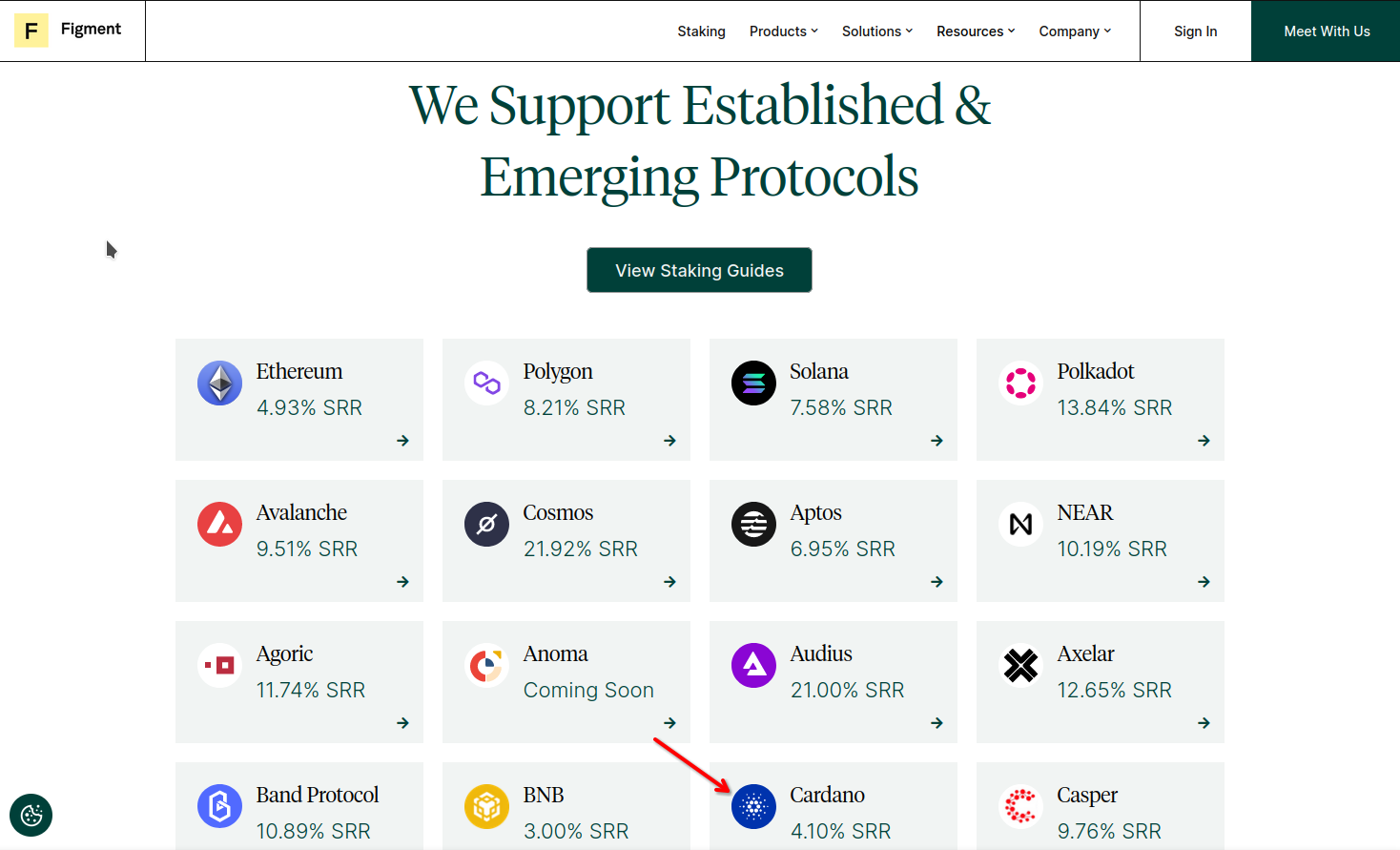

Huge Drop in Staked Ada on May 18th

On May 18th there was a pretty big drop in Staked Ada! This was attributed to Binance continuing to de-stake Ada. But then, a few days later, a pretty decent U-Turn? What is going on?

Binance is Back with New Pools for K=1000

annnd Binance is back. New Pools fully configured for k=1000.

— BALANCE (@BalanceData22) May 31, 2023

hat tip to @earncoinpool and @KpunToN00b (Homer J AAA) in our Matrix Group Edits Chat!

All are welcome to join & help be an On-Chain #Cardano Guardians (dm for a username).https://t.co/9gCb4iD0g0 pic.twitter.com/1b2Q5VmGAf

So Binance is back. They still have their 64 BNP Pools, but low and behold they are creating new pools for K=1000 (or 32MAda Saturation Limit) configuration. Insider tip offs, or smart and proactive?

Regardless, the new pools stole our friend BrotherShip Pool’s Ticker BSP! How rude. Now how will people know who is the real BSP of the Cardano Single Pool Alliance.

Will the real slim shady, please stand up... pic.twitter.com/D64IPsPvem

— BALANCE (@BalanceData22) May 31, 2023

Perhaps the best we can do is make some social media noise by engaging with this tweet by Pool.pm.

In a selfish & careless move, @binance has just created 32 pools with the BSP ticker already used by @BrothershipPool since the very first day of the Shelley era 3 years ago.@cz_binance, it shows a deep lack of care for the #Cardano staking space from you company, please react! pic.twitter.com/qSdYgBgAv7

— pool.pm (@pool_pm) May 31, 2023

Noteworthy Community Updates

- RELAY Stake Pool increased Pledge from 69kAda to 125kAda!

- PRIDE increased pledge from 60k to 75k, nice!. It goes without saying PRIDE pool has been an On-Chain Guardian for Decentralization. Also, he made a really nice SPO Vote dataviz! Check it out..

- The Community is starting to take notice on the Staked Ada Delisting and potential Binance impacts, see Cardano with Paul tweet here. Good looks Smaug!

- More on Atrium Staking Baskets by BLOOM. Looking forward to the details!

- So far from what we can gather it will be a smart contract that will delegate to 50 stake pools (Diffusion) and reward folks with Atrium Token. We definitely need easier on-boarding wallets and tools so this looks good so far. The best part is it will be open sourced which is absolutely crucial for trust.

- MILK Vault Staking by MuesliSwap was announced. Again, limited details, even in the medium blog post. This is another smart contract staking (not private pool with high pledge) like Eternl did, so we’ll be looking for more details here too.

- Homer J [AAA] did some great homework and found a relay pool party!. Although this sounds fun, it’s a high density failure point for many pools. Note, a pool can have many relays, but being dispursed is key.

- The Great OTG Pool is building a mobile stake pool #SPOMAD. Don’t believe me, just check out his tweets below. It’s nice to follow along the industrious experimenter, much like Ben Franklin.

Can your stake pool forge blocks at 65 MPH or on a lonesome dirt road in a town that only has a grid marker for a name?

— 🌟Star Forge⚡ OTG 📡 Stake Pool (@OTG_WCat) May 31, 2023

It won't be much longer till this is a reality.

Support the pool to help me make it a success. Delegate your $ADA to ticker OTG.

Let's do this!#Cardano pic.twitter.com/hfULS20TlW

Topic: SPO Reward Sharing Scheme (RSS) Parameter Vote: k and minPoolCost

Well, by now you know there was a great “experimental” voting event for SPOs over the last few weeks. By “experimental”, it really was a serious litmus test, and the first semi-official Cardano Governance voting event.

If you follow us at BALANCE, you are probably already well aware, but just in case, here’s the Cardano Foundation tweet.

📌Mark the day as we take a step towards #Cardano #governance with the very first on-chain poll. 📊

— Cardano Foundation (@Cardano_CF) May 18, 2023

The #CardanoFoundation has published a first question regarding k and minPoolCost parameters.

🗳SPOs can cast their ballot until the end of the epoch.

➡️https://t.co/tVrI8LnXaK pic.twitter.com/nIzqsEBhj2

The SPO Poll on the Reward Sharing Scheme: k and minPoolCost was a significant catalyst that prompted individuals to contemplate the pools they delegate to, their representation, and, most importantly, the long-term security and decentralization of Cardano through the staking equation parameters.

Stake Pools and Ada Staking Rewards play a crucial role in the monetary policy, blockchain consensus (block minting), as well as in providing resistance against Sybil and Off-Chain Government Attacks through Ada holdings and decentralization.

The Reward Sharing Scheme (RSS) Staking Equation holds immense importance in terms of game theory incentives for long-term decentralization and, consequently, the compelled classification of Ada as a commodity by the SEC.

AdaStat.net did a great job of tracking the poll live and providing results in a exportable .csv format. You can see it here.

The Cardano Foundation (CF) deserves credit for effectively hosting this poll, conducting meetings with SPOs, responding to questions, and being accessible on Telegram Channels (special thanks to Markus) as well as the Forum.

At BALANCE, we possess a deep understanding of the Reward Sharing Scheme (RSS) or the equation governing Staking Rewards for pools and delegators.

We believe that none of the options presented in the poll would offer the freedom of choice and the necessary conditions for a free market, allowing Stake Pool Operators to thrive and determine their own rewards without being restricted by a minimum fee.

Here’s the official statement for the BALNC Pool vote:

BALNC voted "None" for CIP-0094 because our choice for network health and decentralization were not on the ballot, nor given an option, and we stood by our principles.#Cardano Austrian Economics meets Decentralization.https://t.co/dMuVrTPc0b pic.twitter.com/77MMrZ6inL

— BALANCE (@BalanceData22) May 18, 2023

If you’re interested in a detailed explanation of how Multi-Pool Operators can exploit the current reward sharing scheme system through minimum fee “farming” and coercing other pools to join them in imposing high fees, the Great Army of Spies has done an excellent job of breaking it down. They have been a strong advocate for Single Pools and decentralization. We highly recommend watching his video:

That being said, the next few days is the window of opportunity to find a stake pool whose opinion you agree with, and re-delegate your stake. In reality, this is basically a wallet holder’s vote for a pool representative, who will work for the future you want to see in Cardano.

To Delegate is to Vote!

Don’t know what’s up, DM us on Twitter or Join our BALANCE Matrix Chat room, we would be glad to provide eduacation and answer all questions.

📢Calling all Stake Delegators

— Cardano Foundation (@Cardano_CF) May 30, 2023

We are in the re-delegation phase of the #SPO on-chain poll experiment.

➡️View dashboards

➡️See how SPOs voted

➡️Examine results

➡️Decide whether or not to redelegate your stake to another SPO

👇👇https://t.co/QiZg6q5ZAehttps://t.co/nwBgo8LXsN pic.twitter.com/BEiTm7CexI

Note: We have nothing against MPOs and their choice to operate at higher fees, they should be able to charge for their tool building and exceptional service. However, not all pools choose to run at 99.99999% uptime reliability, and by design multi pools have more time upkeep, hardware, and maintenance to attend to. If the RSS was geared toward incentivizing Single Pools, their time, hardware, and effort would be consolidated, and the fees would not need to be so high. The Multi-Pool Model is purely to gain as much minimum fee to remain profitable and spread low fees overall amongst many pools. Even IOG does this model, altough the RSS paper clearly dictates this is harmful to the chain. You are more than welcome to command a high fee for your service, but not all pools choose to run at this level of capacity, and the blockchain is more than resiliant and reliable with many distrubited pools.

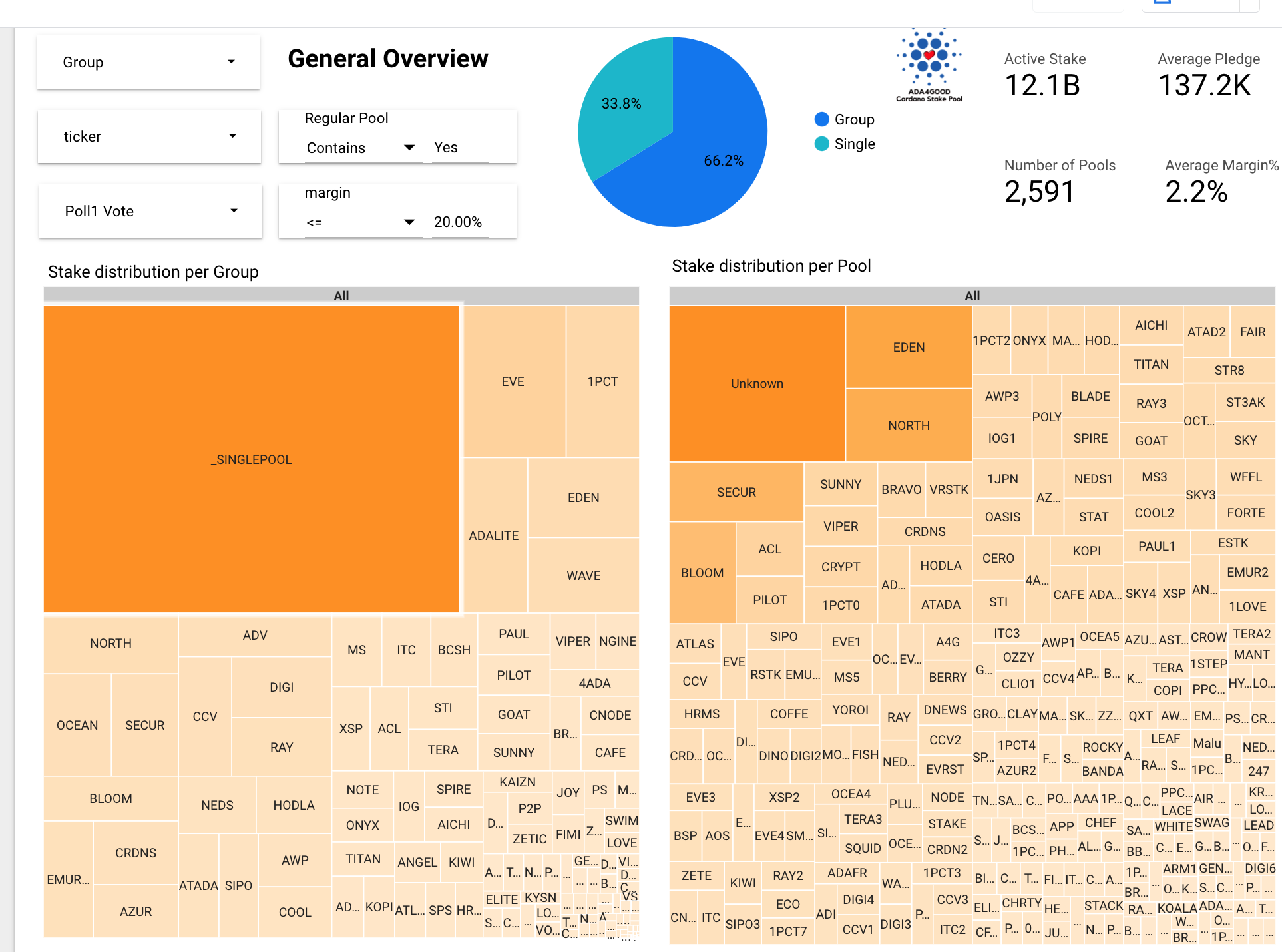

Single Pool Spotlight: A4G Post Pool Voting Dashboard

This week the Single Pool Spotlight Award goes to Ada4Good A4G for his Cardano Pools & K=1000 Dashboard.

Dear #cardano Community,

— ADA4Good ❤️ Cardano Stake Pool (Vahid) (@Ada4goodP) May 24, 2023

I have been working on a report regarding the current distribution of Cardano pools and the possible effects of changing the K Parameter.

The report also includes the Poll results.

Here it is:https://t.co/KkWZYpe9CV

I believe in measurable… pic.twitter.com/o5HrGie19D

In his work, A4G used BALANCE’s Public Pool Group API which we are thrilled about!

Thank you for the contributor page to refernce sources like BALANCE and others, we appreciate it as we grow and build out our capabilities for the Cardano Community! This is the strength of the Community, working together.

Checkout the Dashboard here

What We’re Paying Attention To

- VyFi launch, Staking Vaults, are they private pools or smart contract staking? Seems like lending / DeFi.

- CherryLend token presale rage, ADA sent to presale address, no staking, interesting to see what happens. Another Frosty token sale, hmm?

- MAYZ ISPO: Create, Manage, and Invest in Cardano Funds. Decentralized permissionless, and non custodial protocol. Another ISPO to pay attention to.

- MAYZ Protocol is a decentralized, permissionless, and non-custodial protocol that aims to unlock the full potential of the Cardano ecosystem. By investing in MAYZ, you can create, manage and invest in Cardano funds. Gaining exposure to a diversified portfolio of Cardano native tokens, and MAYZ allows you to capitalize on the various opportunities within the Cardano ecosystem.

- https://twitter.com/MAYZProtocol/status/1660629881518956547

- https://mayz.io/

- MinSwap Pool Saturated? Will they open a new one, or will they community delegation seal their fait as a Cardano Legacy Great?

WOAH... @MinswapDEX $MIN#Cardano $ADA pic.twitter.com/r0ot96DjSv

— BlockchainBill (@BlockchainBill0) June 1, 2023

In addtional to BALNC, there’s quite a few (okay ton) of pools more than willing to provide exceptional service! OTG Pool has a well founded request!

I wish @MinswapDEX, instead of opening another pool(theirs is getting grossly over saturated) they would choose OTG. I have always had great respect for what they have done for our community.

— 🌟Star Forge⚡ OTG 📡 Stake Pool (@OTG_WCat) June 1, 2023

That's the tweet. It's out there now. pic.twitter.com/yw3cW6FCiw

- Revuto has added Indigo’s #iUSD stablecoin staking to their platform services. Revuto has 34,000 followers on Twitter and is a subscription management service. Not entirely sure how this works, but based on their user base this is a good adoption deal. We’ll have to dig into it, or let us know!

- Memecoin craze, sounds fun, but stay safe, and take profits back into $ADA for your Generational Long-term Wealth Fund, of course staked to BALNC!

BALANCE Updates

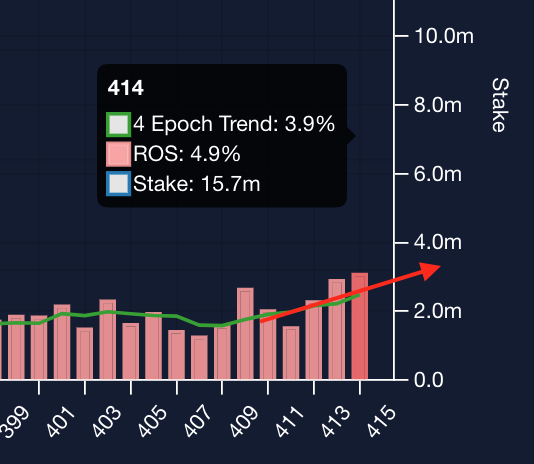

The BALNC Pool Seeing Great Rewards Lately: 4.9% ROS for Epoch 414!

The BALNC Pool has been experiencing amazing rewards lately! For the last Epoch 414, we achieved a 4.9% Return On Stake (ROS), and over the past four (4) epochs, we achieved a 3.9% ROS!

No longer is there a low ROS excuse to not delegate with us. Aside from the BALANCE Web App service we provide, the BALNC pool is hot!

Sidenote: Have you noticed that with the drop in Binance Stake and overall Staked Ada decreasing from 70% to 60%, it has resulted in more blocks won for your pool?

If you think about it, despite having the same number of pools, there is now less Staked Ada and thus a better opportunity/probability to mint a block. Thus, it becomes easier for small single pools to mint a block - effectively a “difficulty adjustment” (using Bitcoin mining terms).

Call to Action: Audit our Pool Group API and Join our Matrix Group Edits Chat

We would like to call for an audit of our Public Pool Group API and invite you to let us know if there are any mistakes. All suggestions are welcomed.

https://www.balanceanalytics.io/api/groupdata.json

Join us in the Group Edits Chat Room in our Matrix Balance Space! Become an On-Chain Cardano Guardian. Alternatively, you can DM us on Twitter.

Cheers,

- The BALANCE Team

Updates: 1) Was “Adastate.net” is now “Adastat.net”, corrected typo. 2) Was “…there is now less Staked Ada and more block supply available to mint. With an increase in block supply and a decrease in demand, it becomes easier for small single pools to win a block-effectively causing a difficulty drop (using Bitcoin mining terms).” is now “…there is now less Staked Ada and thus a better opportunity/probability to mint a block. Thus, it becomes easier for small single pools to mint a block - effectively a “difficulty adjustment” (using Bitcoin mining terms)“. Updated for correctness and clarification. Thank you Homer J of AAA pool.

If you would like to support future research and blockchain analytics, please consider delegating to Balance Stake Pool - [BALNC].

Join the BALANCE Matrix server to get involved and meet the team. Stop by today to help build a more resilient blockchain network.

Join BALANCE Matrix Server