Pool Landscape Report - May 2023 Week 2

Table of Contents

- Pool Landscape Updates

- Noteworthy Community Updates

- Topic: Staked Ada Down, Impacts of DeFi and Memecoin Craze? … or is it Something More?

- Single Pool Spotlight: TERM and COSD

- What We’re Paying Attention To

- BALANCE Updates

Pool Landscape Updates

(4/30/23 Epoch 409 -> 5/15/23 Epoch 411)

More New Multi-Pools, Big Binance Stake Drop, NEW GIRL Gone?, Staked Ada Dropping

Welcome back to the BALANCE Stake Pool Landscape Report. Here’s the big macro picture of what has changed.

Fifteen (15) New Pools have been Created - ~50% are MPOs

Since the last report (April 30th), fifteen (15) new pools have been created.

- Over 50% of the new pools created (this round) are part of Multi-Pool Operations (MPOs).

- WAVE added 1 new pool.

- KID added 2 new pools.

- MS added 1 new pool.

- BD added 1 new pool.

- New pool group SIMBA with 3 pools - same DNS used for relays.

Huge Binance Stake Drop by 55% (1.57BAda)!

There was a significant drop in the Binance group stake, 1.57 Billion (yes, with a B) Ada, resulting in a decrease of 55% of their Live Stake - That’s huge!

- Where did the Ada go? Maybe some wallet sleuths can help. Are they positioning for SEC crackdowns or selling to cover costs?

- K-effective impacts and MAV increased significantly, see for yourself! MAV is now 27.

See for yourself. Here’s a demo of searching for Binance Group and seeing the change from the last 10ish Epochs:

Here’s a demo of seeing the increase in MAV and K-Effective! What’s good to see is the K-Effective, a weighted measure of the pool groups, increasing rapidly. The only question remaining, where is the stake going?

NEW GIRL dead? (335MAda Private Pool, all pledge, 100% margin)

In Epoch 411’s analysis, it was very interesting to see the NEW GIRL private pool group’s Live Stake effectively dropped to zero.

- In the Epoch 411 analysis, it’s interesting to see NEW GIRL attempt to respawn under different POOL IDs.

- ADA was moved through the same stake address within minutes through the same utility.

- Given this finding, the NEW GIRL pool group is re-established using the new pool hash ID values. It appears that new pool IDs and new addresses are being used.

- Even if the funds were indeed a change in ownership, we still believe this to be a legitimate Multi-Pool Operation.

Noteworthy Community Updates

- ARMN Pool honestly doing great work promoting decentralization thru building @plu_ts, a typescript eDSL for Cardano smart contract and transactions.

- The work is being done by @MicheleHarmonic whose twitter bio reads “decentralization first - @hlabs_tech founder - creator of @plu_ts”.

- ARMN is Baremetel, “A pool that supports decentralization through the creation of utility software, running on bare metal servers” (Source: https://harmonicpool.on.fleek.co/).

- The pool is Part of the Cardano Single Pool Alliances. Nice work!

- ADAOZ Pool of Pete (Astroboy) mints 5000 blocks!

- The pool uses a mix between baremetal, cloud, and raspberry pi relays.

- Pete does great community work with no-shill Cardano education and a professional and fun touch. Highly recommend checking out his youtube channel LearnCardano.

- Armada Alliance Docs now has a Parrot AI Helper for Docs. Go give it a spin here.

@alliance_armada now has an AI Parrot integrated into our docs to help you build a node and setup a pool.https://t.co/W1rKQOyMw0 pic.twitter.com/TKLo8FQJui

— 🌟Star Forge⚡ OTG 📡 Stake Pool (@OTG_WCat) May 3, 2023

- HAZEL pool is now 2 years old and upped their pledge 270l -> 325k, well done!

- Support HAZEL’s work for HAZELnet_io Bot: “An enterprise grade Community Integration Tool on Cardano. Discord Bot with NFT & delegator verification & scam protection 🔑 With love from HAZEL 😺”

- GURU pool increased their minFee from 340 -> 813Ada and 0%. Not a bad move.

- Their pool rewards teeter between 500-800, so they should get more rewards but perhaps better pool ranking with 0% margin fee. It’s good to see someone making moves and coming off 340Ada, and it makes sense! You can follow their healthy ROS here.

- JACK stake pool retiring due to outside interests “media business & content to explore more of my interests.”

- Jack has great contributions to Cardano education and onboarding new users. He also provided valient contributions to decentralization. Best of luck in whatever you pursue!

- LOVLK pool retiring. Created in Nov 2021 (Epoch 302)

- LoveLike is a professional operated single pool help us grow and decentralize cardano! LOVLK is committed to stay a singlepool operation! Bio reads as a highly talented and professional dev/ops coder. They were part of the @CardanoSPA. (Source: https://lovelike.io/)

- A bit of a quiet, small pool but none the less a loss in sSPO talent! Thank you for all your work.

Topic: Staked Ada Down, Impacts of DeFi and Memecoin Craze? … or is it Something More?

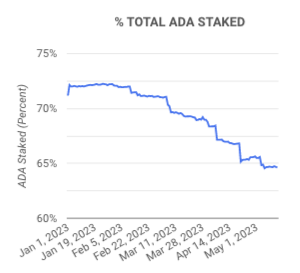

We have observed a consistent decline in Staked Ada, which warrents a bit of investigation: Why?

Source: Cardano Blockchain Insights

Source: Cardano Blockchain InsightsWe tweeted and asked the Cardano Community what they thought. Marco graciously added DeFi is the culprit.

It's #ADA going into DeFi.

— M₳rco Meerm₳n (@MarcoMeerman) May 9, 2023

Influence of DeFi on Staked Ada

This raises the question: Is it a result of the DeFi (Decentralized Finance) and Memecoin frenzy causing less Ada to be staked, or is there something more to the story?

DeFi on Cardano is definitely gaining momentum, and you know the memecoin craze is absolutely wild right now.

Checking DeFiLama the Cardano TVL is definitley on the rise.

Source: DeFiLama

Source: DeFiLamaFrom the Year-To-Date bottom of the curve, the TVL increased by ~95MAda or +190% (not including Staking).

While it’s positive to see the blockchain being utilized for DeFi, we must ensure that the staked Ada doesn’t decrease too much. Staked Ada serves as a defense mechanism against Sybil attacks, providing security to our blockchain through staking instead of relying solely on hash.

Our friend @LiberLion has expressed concerns about the trend if DeFi offers higher yields than staking, will the Staked Ada decrease, and thus decrease network security?

Much of the consensus staking goes to DeFi.

— Li₿εʁLiøη (@liberlion17) April 21, 2023

We see the increase in TVL.

I see a problem here. I saw it before, too.

I wrote this article 2 years ago:

'Stake Pools vs. Liquidity Pools'https://t.co/ASfhdGQHug https://t.co/ty2hLEnnc9

A recent real-world example of liquidity flocking to higher yields is the Apple High Interest Yield Savings Account. High yield has a magnetic effect for sure.

Apple’s, $AAPL, new high yield savings account brought in as much as $990 million in deposits over its first four days, per Forbes.

— unusual_whales (@unusual_whales) May 10, 2023

Hidden Surprise: Big Group Stake Moves to the Downside

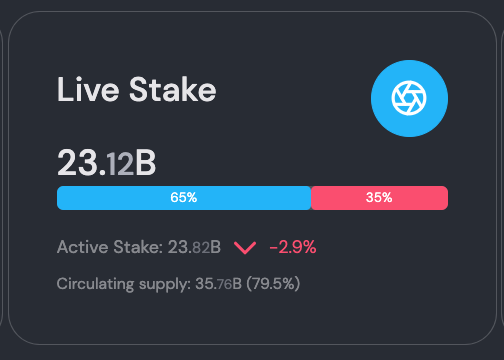

However, upon checking how much total Ada was unstaked even recently, DeFi TVL seems to be only a fraction of the impact. From checking the current amout of Staked Ada today, versus April 1st.

Source: CExplorer

Source: CExplorer- April 1st: 68.4% Staked, ~24.78BAda

- May 15th: 64.6% Staked, ~23.82BAda

That about a -3.9% decline of 966MAda (just under 1BAda). The DeFi TVL raise from Jan 1st was about 94MAda. That’s only a 10% impact. What else is going on?

Well, you may be surprised to find there has been a significant decline in stake from four (4) major pool groups, including Binance!

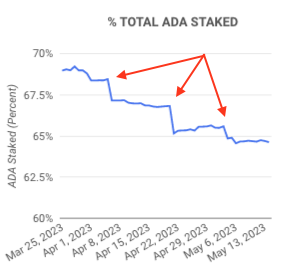

The first clue was the significant sudden drops in staking as seen in the image below:

Source: Cardano Blockchain Insights

Source: Cardano Blockchain InsightsWhat do these dates correspond with? From reviewing our charts and checking the Epoch Calendar, the following was noteworthy:

The most significant drops in staking occurred on the following dates:

- April 5th, Epoch 403 to 404 - BCSH and New Guy experienced significant changes.

- April 20th, Epoch 406 to 407 - Binance witnessed a substantial drop.

- May 3rd, Epoch 409 - Binance experienced another decrease.

From checking our BALANCE Stake Vs Leverage Pool Group Chart, the following stake changes took place amoung these four (4) large pool groups.

Staked Ada Changes from Epoch 390 (Jan 30th) to 411 (May 15th)

- BINANCE -55% decrease for -1,573MAda (Wow!)

- COINBASE -16% decrease for -420MAda

- BCSH -17% decrease for -24MAda

- NEW GUY -39% decrease for -140MAda

That’s a combined Staked Ada loss of -2.15 Billion Ada, or a combined -36% change in stake among the four (4) groups total.

So, assuming around Jan 1st the Staked Ada was 72% or 25.8BAda, and today it’s 65% for 23.8BAda, thats a loss of -7% or -1.8BAda.

In short, it appears the Staked Ada decrease is definitely reflected in the loss of Stake from these 4 big pool groups. Whether or not it’s being sold or put into DeFi not reflected in DeFiLama is unknown, but DeFi alone seems unlikely. Let us know what you think.

Single Pool Spotlight: TERM and COSD

We would like to give kudos to two outstanding community members:

They both have been diligently contributing to CIPS, Cardano Forums, and the Cardano Professional Society in the Matrix. Both are extremely erudite, steadfast, and kind. Additionally, their stake pools are shining examples of good actors in the landscape.

Thank you both for all that you do. Please check out their stake pools!

Note: TERM has an extremely high pledge, about ~3MAda, and he could easily split the pool into an MPO and minFee farm the 340Ada and win more blocks. Instead, like many others, they are steadfast in changing the Reward Sharing Scheme Game Thoery. This is a shining example of the right thing to do for network health. Pledge should matter more.

What We’re Paying Attention To

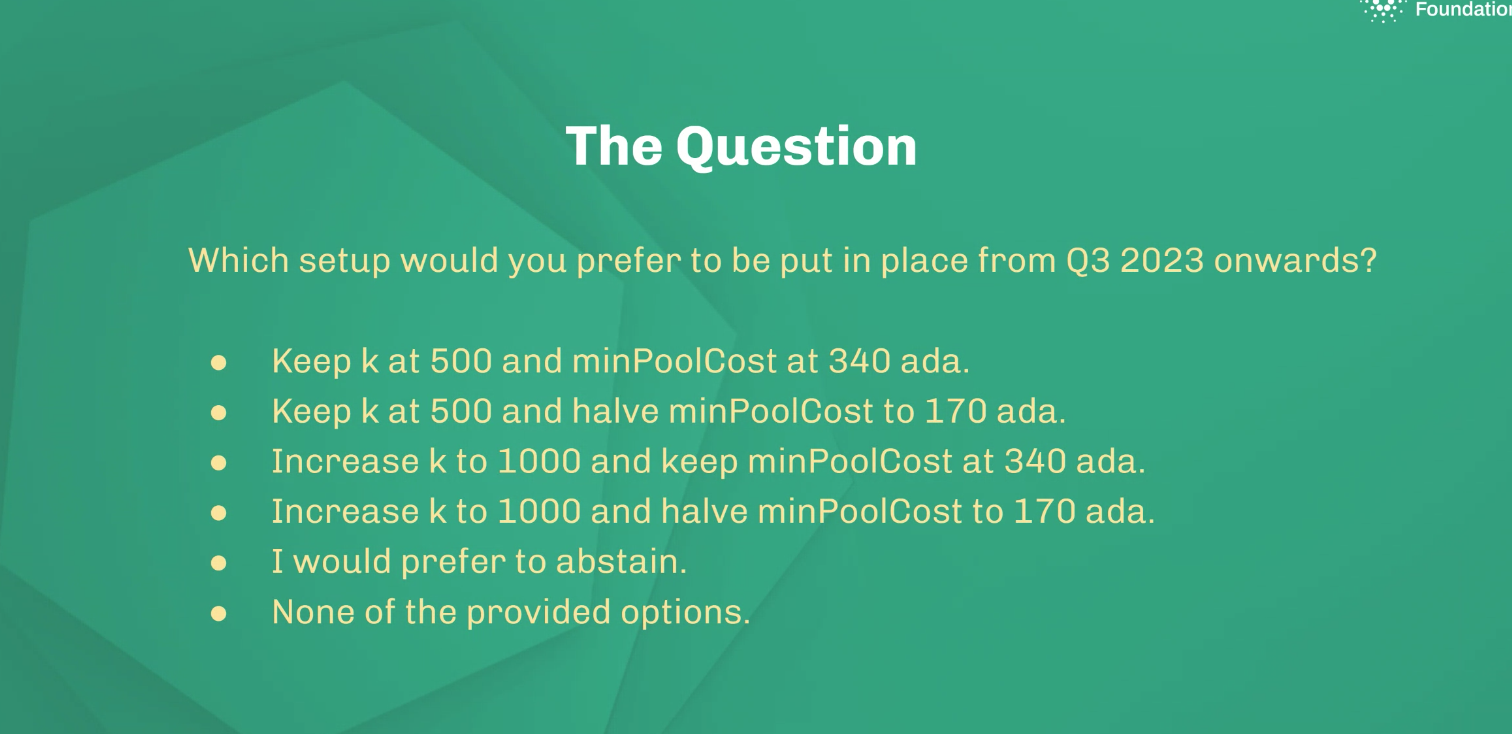

- Cardano Foundation SPO On-Chain Poll for Stake Pool Reward Sharing Scheme (RSS) Parameters.

- A lot of rekindled discussion on twitter. Make sure to check how your Stake Pool will vote (if they can).

- What do you think will happen? Pro tip: watch the Coinbase stake pools for the answer.

- Big Pey & Atrium Smart Contract “Staking Baskets” for Multi-Delegation - Wow!

- https://youtu.be/HYD5PoDSDfY min 4:30

- Big Pey Helping Decentralization in a Big Way

- Community will vote on 50 single pools

- Newb onboarding and education focused

In collaboration with @MLabs10 we're writing smart contracts that allow users to create staking baskets.

— big pey (@bigpeyYT) May 9, 2023

Our first staking baskets is called 'Diffusion'! Diffusion is focused on decentralizing #Cardano.

Users will be paid their $ADA rewards + $Atrium tokens. pic.twitter.com/zCYVHgOZkU

- Djed reserve ratio has been under 400% for a while at 360% on 5/8/23. Only within last week is it now above 400% reserves again. Does this have any Staked ADA impacts? Is SHEN Staked yet?

BALANCE Updates

- We are in the trenches, working on more charts. The Svelte + D3 learning curve is steep, and there are few open-source references, but once we overcome this hurdle, we should be able to create charts more efficiently.

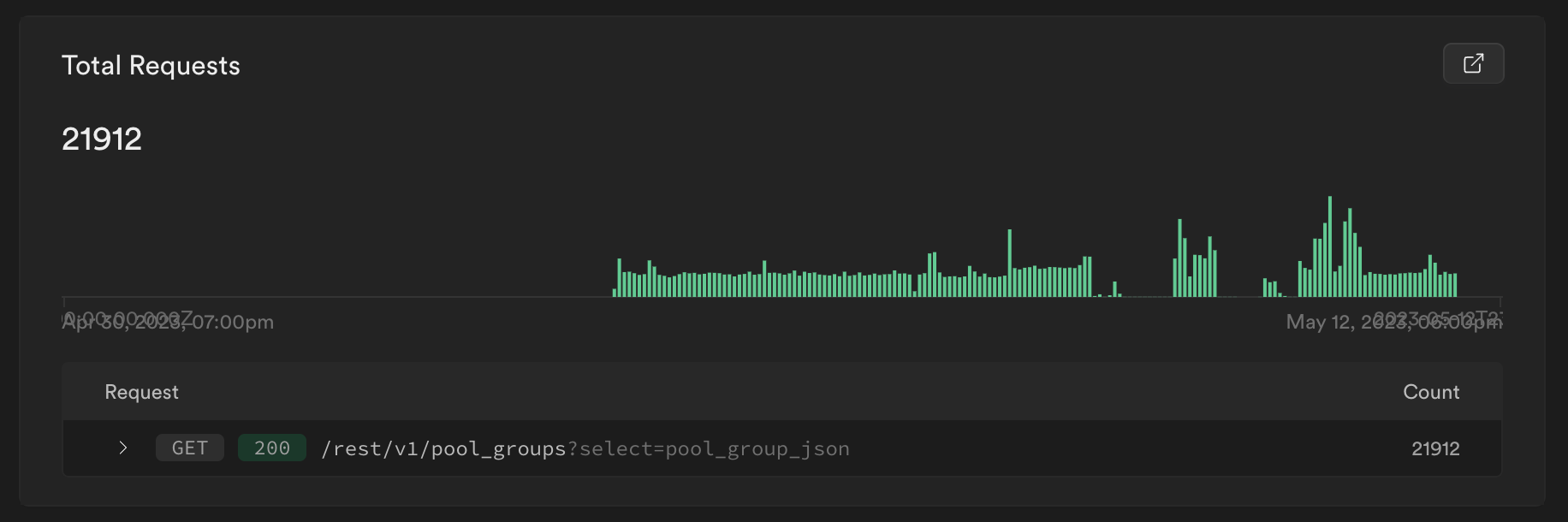

- The Public Pool Group API is starting to receive hits, which is a positive growth metric!

If you would like to support future research and blockchain analytics, please consider delegating to Balance Stake Pool - [BALNC].

Join the BALANCE Matrix server to get involved and meet the team. Stop by today to help build a more resilient blockchain network.

Join BALANCE Matrix Server